Sustainable Governance

Risk Management

ARIZON RFID Technology (Cayman) Co., Ltd. established its Risk Management Policy and Procedures, approved by the Board of Directors in 2022. A Risk Management Organization was set up as the responsible unit to execute risk management, chaired by the Corporate Governance Officer. This organization is primarily responsible for monitoring, measuring, and assessing company risks, assisting in formulating risk management policies, ensuring the implementation of Board-approved risk management decisions, and coordinating overall risk management operations.

The Risk Management Organization supervises and ensures that risk management practices comply with Board policies and reports its operations and outcomes at least once a year to the CEO and the Board of Directors.

Operational Highlights (2025):

November 11, 2025 – Board of Directors:

Revised the Risk Management Policy and Procedures and reported on the 2025 risk management status.

December 23, 2025 – Sustainability Committee:

Reported the 2025 risk assessment items and management strategies conducted by the company’s Risk Management Team.

Risk Management Organization

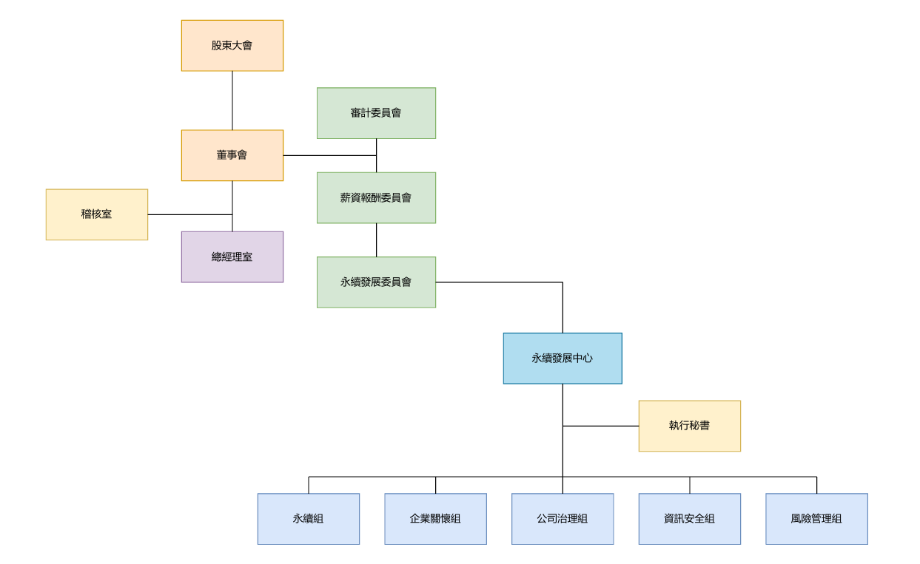

In order to align with the strengthening of corporate governance and practical operational needs, the Company revised its Risk Management Policies and Procedures at the Board meeting convened in November 2025, adjusting the existing risk management function to be handled by the Sustainable Development Committee under the Board of Directors. This adjustment strengthens the Board’s overall supervision and guidance functions over the risk management mechanism.

In addition to being responsible for supervising the Company’s overall risk management operation mechanism, the Sustainable Development Committee shall also review and make recommendations on major risk management–related matters, and submit relevant proposals to the Board of Directors for review and resolution, so as to ensure the transparency and consistency of decision-making.

Risk Management Policy and Procedures

This procedure is formulated in accordance with Article 44 of the Guidelines for Establishing Internal Control Systems by Public Companies and the Practical Guidelines for Risk Management of Listed Companies. Unless otherwise specified by law or the company’s internal regulations, the company’s Risk Management Promotion and Execution Unit implements risk management in accordance with this procedure.

The company’s risk management policy is:

“Through systematic and institutionalized management, effectively identify, prevent, and control risks to maintain normal operations and achieve sustainable business performance.”

The complete policy can be found in the company’s Major Internal Regulations .

The company’s risk management organizational structure includes the Board of Directors, Sustainability Committee, Risk Management Team, operational units involved in risk-related matters (including subsidiaries), and the Audit Unit.

Roles and Responsibilities in Risk Management:

I. Board of Directors (Highest Risk Governance Body)

- Approve risk management policies, procedures, and organizational structure.

- Ensure alignment between operational strategies and risk management policies.

- Ensure appropriate risk management mechanisms and a risk-aware culture are established.

- Supervise and ensure the effective operation of the overall risk management framework.

- Allocate and assign sufficient and appropriate resources to enable effective risk management.

II. Sustainability Committee

- Review risk management policies, procedures, and structure, and regularly assess their applicability and effectiveness.

- Approve risk tolerance levels and guide resource allocation.

- Ensure that risk management mechanisms adequately address company risks and are integrated into daily operations.

- Approve risk control priorities and risk levels.

- Review risk management implementation, provide necessary improvement recommendations, and report to the Board at least once a year.

- Execute risk management decisions as determined by the Board.

III. Risk Management Team (Risk Management Promotion and Execution Unit)

- Develop risk management policies, procedures, and organizational framework.

- Define risk appetite (tolerance) and establish qualitative and quantitative measurement standards.

- Analyze d identify sources and types of company risks, and regularly review their applicability.

- Compile and submit annual risk management implementation reports.

- Assist and supervise the execution of risk management activities across departments.

- Coordinate cross-departmental interaction and communication for risk management operations.

- Execute risk management decisions of the Sustainability Committee’s Risk Management Team.

- Plan risk management training programs to enhance overall risk awareness and culture.

IV. Operational Units Involved in Risk-Related Matters (Including Subsidiaries)

- Identify, analyze, evaluate, and respond to risks within their respective units, and establish relevant crisis management mechanisms if necessary.

- Regularly report risk management information to the Risk Management Team of the Sustainability Committee.

- Ensure that risk management and related control procedures are effectively implemented within their units in accordance with risk management policies.

V. Audit Unit (Supervisory Body)

The company’s Audit Unit reports directly to the Board of Directors and is responsible for overseeing the risk management of the company and its subsidiaries. Auditors conduct independent internal audits of all company departments and subsidiaries, regularly providing audit results and improvement recommendations to the Board and management to ensure that operational risks are effectively managed.

The company adheres to the principles of prudent operation and continuous improvement, striving to establish a comprehensive risk management framework and system in line with sustainable management trends. Through the supervisory mechanisms of the Board of Directors and the Sustainability Committee, combined with cross-departmental collaboration and risk identification processes, the company strengthens its resilience and response capabilities in a dynamic environment.

Going forward, the company will continuously review the effectiveness of its risk management system and, in response to operational strategies, industry trends, and changes in external regulations, make timely adjustments to relevant policies and procedures. This ensures that risk management operations align with the company’s long-term sustainable development goals. Through institutionalized, systematic, and transparent management practices, the company implements the core principles of “Risk Control, Prudent Operation, and Sustainable Innovation”, continuously enhancing corporate governance quality and overall competitiveness.

2025 Risk Management-Related Training

| Course Name | Participants | Training Hours |

| Code of Ethical Conduct and Insider Trading Prevention Practices | 77 | 231 |

| Personal Data Protection and Information Security Practices | 77 | 115.5 |